Turn Customer Feedback Into Revenue.

We created the only CX software platform designed and built exclusively for professional services firms, offering real-time capabilities to collect, analyze, respond to, and take action on customer feedback.

Working with organizations like:

Who Is Client Savvy?

A Consultative Approach to Analyzing Customer Feedback

Client Savvy was founded in 2004 with the goal of assisting professional service companies in better understanding their customers' expectations and converting their valuable feedback into company improvements - and therefore increased business.

Perfecting the customer experience (CX) can be a challenge. From our proprietary CX software technologies to our hands-on advisory CX services, we give you the knowledge you need to guide you through the feedback response process from start to finish.

Our Process for Optimal CX

Consultative Listening

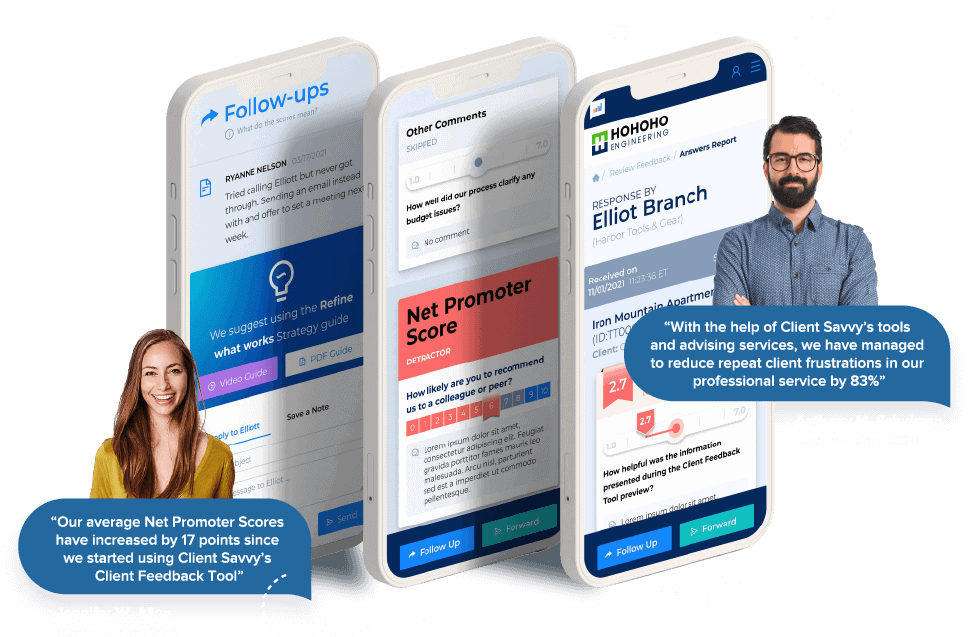

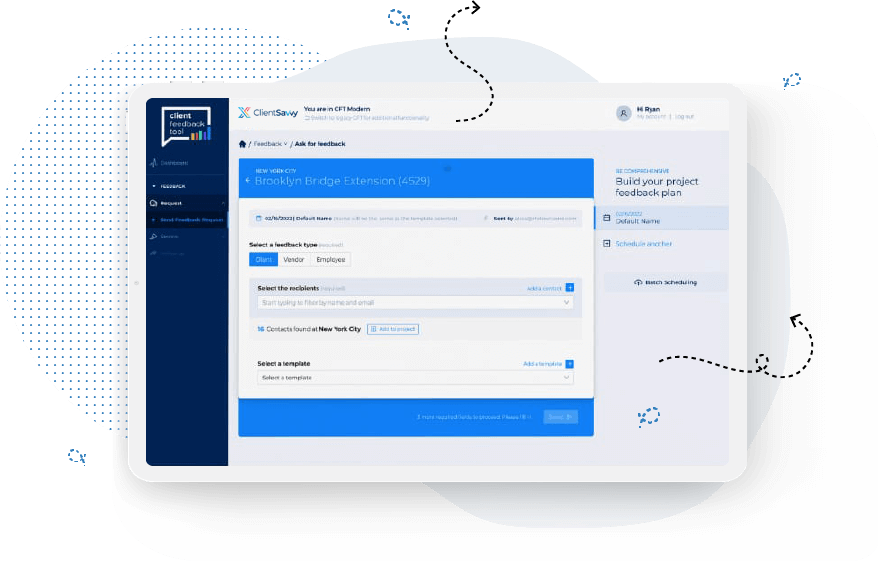

Our patented CX software technology combined with our expert advisory services allow you to personalize feedback request templates tailored specifically to your business. Once you’ve received responses, all of this data is stored in one easy-to-analyze system.

Meet & Discuss: Customer Feedback Analysis

We help you to process and interpret the data received from your feedback to completely understand what it's telling you and work together to conceptualize a plan of action.

Implement Your

Approach For Results

With the help of Client Savvy, you’ll never have to wonder what to do next (or how). Our professional CX services help you put your plan into action to optimize your company’s feedback response process and meet your long-term CX goals.

Customer Experience Solutions

Empathy Mapping

We help you measure the emotional needs, drivers, fears, questions, and anxieties through Empathy Mapping.

Linguistic Analysis

Provides insight into the sentiments, meaning, and themes present in the comments that accompany feedback scores.

Seller-Doer Training

Our Seller-Doer Business Development Training guides participants through development strategies.

Journey Mapping

Understanding your client’s experience from their perspective will separate you from your competitors.

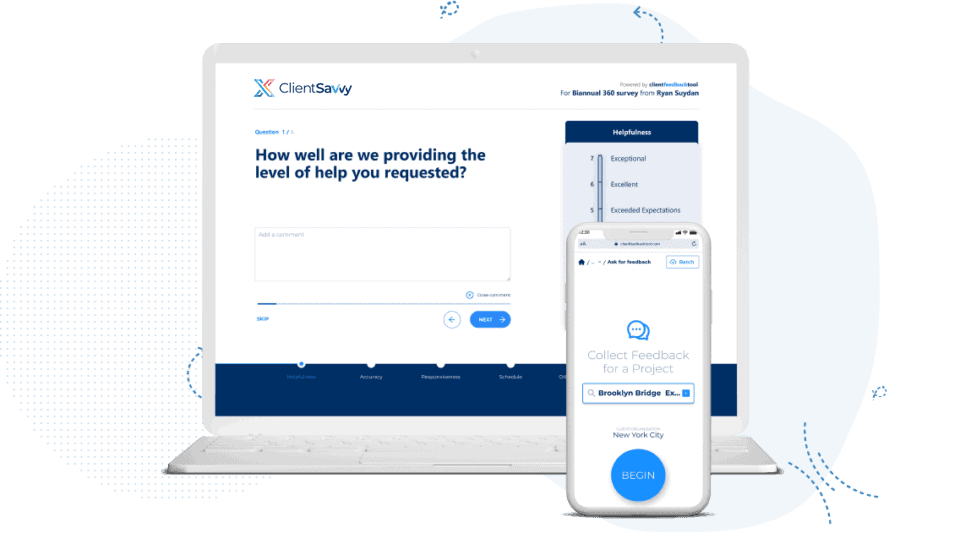

Our Customer Feedback Survey Software

Our Customer Feedback Software is a B2B customer experience platform for professional services that provides valuable insight into your business and allows you to maintain positive relationships, gain repeat customers, and increase sales without hard-selling.